Introduction to Luxury Home Buying

The allure of luxury homes lies in their unique blend of opulence, architectural beauty, and prime locations. Buyers are often captivated by the prospect of owning a stunning property that not only serves as a residence but also symbolizes success and prestige. The luxury real estate market appeals to individuals seeking an elevated lifestyle, offering exclusive amenities, breathtaking views, and personalized features that cater to affluent tastes.

However, common misconceptions surround the luxury home buying process. Many believe that the process is markedly simpler than purchasing a standard home due to the high price tag, when in fact, it can be quite the opposite. Navigating this market requires a discerning eye and a comprehensive understanding of the nuances involved. Additionally, prospective buyers often focus solely on the purchase price, neglecting to consider other costs that can significantly impact their overall investment.

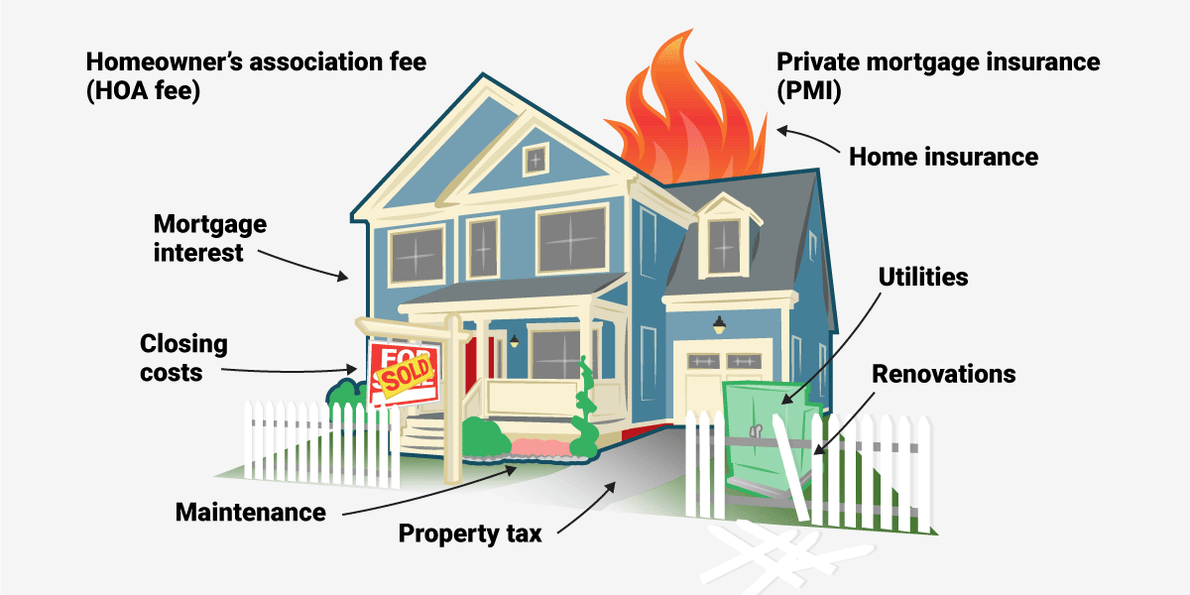

Understanding total costs beyond the purchase price is crucial for anyone contemplating a luxury home purchase. While the listing price may seem like the most significant expense, numerous hidden costs can arise. These include maintenance fees, property taxes, insurance, and unexpected repairs. Each of these factors plays a vital role in determining the true cost of ownership and should be carefully evaluated to avoid financial surprises down the road.

Factors Influencing Total Ownership Costs

When contemplating the purchase of a luxury home, it’s essential to be aware of the various elements that can affect total ownership costs. The following points highlight key factors that should be factored into your financial planning:

- Property Taxes: Luxury homes often come with higher property tax rates, which can vary significantly based on location. For example, properties in sought-after areas may have tax assessments that reflect their market value, leading to substantial annual expenses.

- Maintenance and Upkeep: The upkeep of a luxury property can be demanding. Features like expansive gardens, pools, and elaborate interiors require regular maintenance. Depending on the size and complexity of the home, these costs can range from a few hundred to several thousand dollars monthly.

- Homeowners Association (HOA) Fees: Many luxury homes are part of exclusive communities with HOAs that impose additional fees. These fees cover amenities and services that enhance the living experience but should be understood upfront to budget effectively.

- Insurance Costs: Luxury homes typically require specialized insurance coverage to protect against potential risks. This can result in higher premiums compared to standard homeowner insurance, especially in areas prone to natural disasters.

- Long-term Investment Considerations: Understanding the potential for appreciation or depreciation in property value is key. Market trends can significantly impact your investment’s future value, making it essential to conduct thorough research on local real estate dynamics.

“The true cost of owning a luxury home often extends well beyond the initial purchase price, requiring careful consideration of ongoing expenses.”

Investing in a luxury home demands a well-rounded perspective on not just the aesthetic and emotional appeal of the property, but also the financial implications tied to ownership. Being informed about these factors will empower buyers to make prudent decisions and navigate the luxury real estate landscape with confidence.

The Initial Purchase Costs

When diving into the luxury home market, potential buyers need to be aware of the various upfront costs that come with purchasing such properties. These initial purchase costs can significantly impact the overall budget and financial planning for your dream home. Understanding these expenses will help buyers make informed decisions and avoid financial strain down the road.

One of the primary components of these initial costs involves the down payment. Luxury homes typically expect higher down payments compared to standard properties, often ranging from 20% to 30%. For instance, if you’re eyeing a $2 million luxury home, you might be looking at a down payment of $400,000 to $600,000. Additionally, mortgage considerations become crucial as well; luxury properties may require more stringent financial documentation and sometimes carry higher interest rates depending on your financial health and credit history.

Closing Costs and Associated Fees

When purchasing a luxury home, it’s essential to account for closing costs, which can be significantly higher than those associated with standard homes. These costs cover various fees and expenses that are incurred when finalizing the purchase. Below are some key components of closing costs specific to luxury properties:

- Title Insurance: Protects against potential disputes over property ownership. This can range anywhere from $1,000 to over $3,000 depending on the property value.

- Escrow Fees: These fees are paid to a neutral third party who handles the financial transaction. Costs can vary but are typically around 1% of the purchase price.

- Inspection Fees: Comprehensive inspections are crucial for luxury homes, which may include specialized inspections (e.g., for pools, roofs, or appliances). These can run from $500 to $2,000 or more.

- Property Taxes: Luxury properties can have significant property tax obligations. Buyers should factor in local tax rates, which can vary greatly.

- Homeowner’s Association (HOA) Fees: Many luxury homes may be within communities with HOA fees, which can range from a few hundred to several thousand dollars annually.

A well-prepared buyer should anticipate these costs and budget accordingly, ensuring that all aspects of the home buying process are covered without unexpected financial burdens. By understanding these initial purchase costs, buyers can navigate the luxury market more effectively.

Ongoing Maintenance and Upkeep

Maintaining a luxury home goes beyond the initial purchase price and encompasses a variety of ongoing costs that can significantly impact your budget. Understanding these routine maintenance expenses is crucial for any homeowner, as they contribute to the overall ownership experience and long-term value retention of the property.

The maintenance costs for luxury homes can be notably higher than those for standard properties due to their unique features and amenities. Homeowners should anticipate expenses related to regular upkeep, which can include everything from routine cleaning to specialized maintenance for high-end installations.

Routine Maintenance Costs

Routine maintenance is essential to preserving the value and aesthetics of a luxury home. This includes a range of services that should be factored into your annual budget. Common expenses can include:

- General repairs and upkeep: Routine inspections and repairs on items such as roofing, plumbing, and electrical systems can add up over time. It’s wise to allocate a percentage of the home’s value annually for these unexpected repairs.

- Heating, ventilation, and air conditioning (HVAC) servicing: Regular servicing of HVAC systems is necessary for efficiency and longevity, often costing between $200 to $500 per year, depending on the size and complexity of the system.

- Cleaning services: Whether it’s window washing or deep cleaning, maintaining the pristine condition of a luxury property often requires professional cleaning services, which can range from $150 to $500 per visit, depending on the size of the home.

Landscaping and Pool Maintenance

Luxury homes often feature expansive landscaping and swimming pools, both of which require ongoing maintenance. This aspect of upkeep can be a significant part of your annual budget.

Investing in professional landscaping services is essential to keep gardens and lawns looking immaculate. Regular maintenance tasks include:

- Lawn care: Regular mowing, fertilizing, and pest control can average between $100 to $400 per month, depending on the property’s size and the complexity of the landscaping.

- Seasonal planting and pruning: Hiring a landscape designer or gardener can ensure that seasonal changes enhance the property’s aesthetics, costing between $300 to $1,500 each season.

Pool maintenance is another critical component. Monthly costs can vary based on the type of pool and its features, but typical services include:

- Water balancing and chemical treatments: Regularly testing and adjusting pool chemistry can run from $80 to $150 monthly.

- Cleaning and equipment checks: Professional cleaning and maintenance of pumps and filters may cost about $100 to $300 monthly.

Importance of a Maintenance Fund

Having a dedicated maintenance fund is essential for any luxury homeowner. This fund serves as a financial buffer for unexpected repairs and maintenance tasks that can arise at any time.

It’s advisable to set aside approximately 1% to 3% of the home’s value each year for maintenance costs. For instance, if your luxury home is valued at $1 million, setting aside $10,000 to $30,000 annually can ensure you’re prepared for those unforeseen expenses that may arise, such as a sudden roof leak or HVAC failure.

By proactively managing ongoing maintenance and creating a comprehensive budget that includes these elements, luxury homeowners can enjoy their properties without the stress of unexpected financial strains.

Property Taxes and Insurance: The Hidden Costs Of Buying A Luxury Home And How To Avoid Them

Understanding property taxes and insurance is essential when purchasing a luxury home. These factors can significantly impact the overall cost of ownership, often surprising new buyers with their magnitude. Property taxes vary by location and are based on the assessed value of the home, while insurance needs can be more complex due to the unique features and higher value of luxury properties.

Property Tax Determination and Fluctuations

Property taxes for luxury homes are usually calculated as a percentage of the assessed property value, which can be influenced by various factors including local real estate market conditions, property enhancements, and changes in tax laws. In many regions, luxury homes might be subject to higher tax rates due to their market value.

The assessed value is typically determined by local tax assessors who evaluate similar properties in the area. These assessments can fluctuate based on market trends. For example, if a neighborhood experiences a boom in property values, luxury homeowners might see an increase in their property taxes.

| Factor | Impact on Property Tax |

|---|---|

| Market Trends | Increased demand can raise home values, leading to higher taxes. |

| Property Improvements | Renovations or upgrades typically increase assessed value. |

| Tax Legislation Changes | Changes in local tax law can result in tax rate adjustments. |

“Understanding the local market dynamics is crucial to anticipate property tax changes.”

Types of Insurance for Luxury Properties

Luxury homes require specialized insurance coverage due to their higher value and often unique features. Standard homeowners’ insurance may not cover all potential risks associated with luxury properties, such as high-value art collections, expensive fixtures, or additional structures like guest houses or pools.

Typical insurance types that luxury homeowners should consider include:

- Homeowners Insurance: Comprehensive coverage that protects against damage to the home and personal property.

- Umbrella Insurance: Provides liability coverage beyond standard policies, protecting against lawsuits and major claims.

- Flood Insurance: Essential for properties in flood-prone areas, which standard policies may not cover.

- Valuable Items Insurance: Specialized coverage for high-value belongings, such as jewelry and artwork.

It’s imperative to work with an insurance agent experienced in luxury homes to tailor coverage to specific needs and risks.

Cost Comparison of Homeowners Insurance

Homeowners insurance costs can vary widely between standard and luxury homes. Typically, luxury homeowners pay significantly more due to the increased value of their properties and the higher costs associated with repairing or replacing luxury finishes and features.

The average cost of homeowners insurance for a standard house can range between $1,000 to $2,000 annually, while luxury homeowners might face premiums that start at $2,500 and can exceed $10,000 depending on location, home value, and additional coverage needs.

Factors that influence insurance premiums for luxury homes include:

- Property Location: Areas prone to natural disasters or high crime rates will typically incur higher premiums.

- Home Value: The greater the property’s value, the higher the coverage needed, which increases insurance costs.

- Security Features: Homes with advanced security systems may receive discounts on premiums.

“Investing in the right insurance coverage for a luxury home is as crucial as the initial purchase.”

Hidden Costs in Luxury Home Features

Purchasing a luxury home often comes with distinctive features designed to enhance comfort and convenience. However, these high-end amenities can lead to unexpected financial burdens. Understanding these hidden costs is crucial for prospective buyers who want to enjoy their luxury lifestyle without breaking the bank.

Luxury homes typically boast advanced technology and premium appliances that add significant value but also come with hidden costs. For instance, smart home systems provide convenience and security but can increase both installation and maintenance expenses. High-end appliances often require specialized service and can lead to higher utility bills due to their advanced functions. While these features enhance the living experience, they also demand careful consideration of their long-term financial implications.

Common Luxury Home Features and Cost Implications

When evaluating luxury home features, it’s important to recognize the potential costs associated with their installation, maintenance, and operation. Below is a list of common luxury features along with their associated cost implications, highlighting why they can significantly impact your budget over time.

- Smart Home Technology: The initial investment in smart home devices can range from a few thousand dollars to tens of thousands, depending on the complexity of the system. Ongoing costs for software updates, monitoring services, and potential replacements can accumulate quickly.

- High-End Appliances: Premium kitchen appliances, such as professional-grade ovens and refrigerators, not only cost more upfront but can also lead to increased energy consumption. The difference in energy efficiency between standard and luxury models can significantly affect monthly utility bills.

- Outdoor Living Spaces: Features like outdoor kitchens or elaborate landscaping enhance outdoor living but come with maintenance costs. Regular upkeep, seasonal preparations, and potential repairs can add thousands to annual expenses.

- Luxury Flooring: High-quality materials such as hardwood or marble provide aesthetic appeal but require specialized cleaning and maintenance, which can be costly over time. Additionally, replacement costs for damaged areas can be substantial.

- Advanced HVAC Systems: While designed to provide optimal climate control, high-efficiency systems can incur higher installation costs. Ongoing maintenance and potential repairs can also lead to increased expenditures, especially if specialized technicians are required.

“The allure of luxury home features often comes with a price tag that extends beyond initial purchase costs, making it essential to fully assess their long-term financial impact.”

Understanding these hidden costs can help you make informed decisions when investing in a luxury home. By recognizing the financial responsibilities tied to lavish features, you can better prepare for the ongoing costs of ownership, ensuring that your dream home remains a joy rather than a financial burden.

Financing and Loan Options

When it comes to purchasing a luxury home, understanding the financing options available is crucial. Luxury homes often come with higher price tags, and as such, the financing landscape can be quite different from traditional home purchases. Buyers must navigate specific loan products and requirements tailored to high-value properties, ensuring they choose the best option for their financial situation.

Luxury home financing options typically include conventional loans, jumbo loans, and portfolio loans. These options cater to buyers who need to secure financing that exceeds conventional loan limits, which can be particularly important in high-cost markets. Understanding the nuances of each loan type can help buyers avoid pitfalls.

Loan Requirements for High-Value Properties

Securing a loan for luxury properties generally involves more stringent requirements compared to standard home loans. Lenders usually look for buyers with excellent credit scores, substantial income, and significant assets. The following key factors are considered:

- Credit Score: A credit score of 700 or higher is often necessary to qualify for luxury home financing, as lenders want to minimize risk.

- Down Payment: Luxury homebuyers might be required to make a larger down payment, often ranging from 20% to 30%, depending on the lender and property value.

- Debt-to-Income Ratio: Lenders typically prefer a debt-to-income ratio of 43% or lower. This means that your monthly debt payments should not exceed 43% of your gross monthly income.

- Asset Reserves: Many lenders require buyers to demonstrate they have sufficient cash reserves to cover several months of mortgage payments, taxes, and insurance.

Fixed-Rate vs. Adjustable-Rate Mortgages

When financing a luxury home, buyers often face the decision between fixed-rate and adjustable-rate mortgages (ARMs). Each has its advantages and disadvantages depending on the buyer’s financial strategy and market conditions.

A fixed-rate mortgage offers stability with a consistent interest rate throughout the loan term, making budgeting easier. This can be particularly advantageous in a rising interest rate environment.

Conversely, an adjustable-rate mortgage typically starts with lower initial rates that can lead to significant savings upfront; however, the rates can fluctuate based on market conditions after an initial fixed period. Buyers need to consider the potential long-term implications of rising rates.

“The choice between fixed-rate and adjustable-rate mortgages significantly influences long-term financial health and cash flow management.”

Understanding these financing options allows luxury homebuyers to make informed decisions that align with their financial goals, ensuring a smoother purchasing process.

Real Estate Agent Fees and Commissions

When purchasing a luxury home, understanding the structure of real estate agent fees and commissions can significantly impact your overall investment. Luxury properties often come with unique challenges and opportunities, making it crucial to navigate agent costs effectively. This section delves into typical commission structures, the nuances of negotiating fees, and the advantages of working with specialized agents in the luxury market.

Typical Commission Structures, The Hidden Costs of Buying a Luxury Home and How to Avoid Them

In the luxury real estate market, commission structures usually differ from standard residential transactions. While a common commission might range from 5% to 6% of the property’s sale price, luxury agents often negotiate a tiered commission based on the sale price.

For example:

- For properties under $1 million, a commission of around 6% is common.

- For homes priced between $1 million and $3 million, commissions may decrease to about 5%.

- On properties over $3 million, commissions can drop to 4% or even lower, depending on the negotiation.

This tiered approach allows significant savings on higher-valued properties, but it is essential to understand that agents may still prioritize their total earnings.

Negotiating Agent Fees

Negotiating agent fees in luxury real estate transactions is not just possible; it’s often expected. Buyers should approach negotiations with the knowledge of the market and the specific property in question. Consider the following strategies:

- Research the agent’s recent sales to gauge their performance and market knowledge.

- Discuss the unique value you bring as a buyer, such as being pre-approved for financing.

- Express openness to a reduced commission in exchange for a quicker sale or a more substantial commitment.

By offering a strong rationale for lower fees, buyers can sometimes secure better deals without compromising on service.

Benefits of Specialized Agents

Working with a specialized agent in the luxury home market can provide substantial benefits, making the buying process smoother and more efficient. Specialized agents often possess extensive knowledge of the local luxury market, including:

- Access to exclusive listings not available to the general public.

- Insight into market trends that affect luxury pricing and value.

- Established networks with other professionals such as appraisers, inspectors, and contractors.

Having an agent who understands the nuances of luxury purchases can lead to better negotiation outcomes and a more satisfying buying experience. Additionally, their expertise can help uncover hidden costs that may arise during the buying process, ensuring you are prepared for any unexpected expenses.

Long-Term Investment Considerations

Investing in luxury real estate can be enticing, but it comes with its own unique set of risks and rewards that investors must carefully evaluate. Understanding market trends and the significance of location can greatly impact the success of your investment over time.

Evaluating the long-term merits of luxury home investments requires a thorough assessment of potential risks and rewards. The luxury real estate market is often volatile, influenced by economic conditions, interest rates, and buyer demand. However, when the right property is acquired in a prime location, the rewards can be significant, including appreciation in property value and rental income opportunities.

Potential Risks and Rewards

Luxury real estate can offer compelling rewards, but it is crucial to understand the accompanying risks that may affect your investment. The following points highlight some important factors to consider:

- Market Volatility: The luxury market can experience significant fluctuations influenced by economic trends, such as recessions, which may reduce buyer demand.

- High Maintenance Costs: Luxury properties often require extensive upkeep, which can lead to unforeseen expenses that impact long-term profitability.

- Liquidity Concerns: Unlike more affordable housing, luxury homes can take longer to sell, which may pose challenges if you need to liquidate your asset quickly.

- Potential for Depreciation: While luxury properties can appreciate, they can also depreciate due to poor market conditions or changes in neighborhood dynamics.

- Demand Fluctuations: The desirability of high-end properties can vary with shifts in buyer preferences, impacting overall value.

Understanding these factors helps investors make informed decisions regarding their luxury home purchases.

Market Trends Affecting Luxury Property Values

It’s essential to stay abreast of the market trends shaping luxury property values. Notable aspects influencing these trends include:

- Economic Indicators: Factors such as GDP growth rates, employment levels, and consumer confidence heavily influence luxury home values.

- Interest Rates: Fluctuating interest rates can affect mortgage affordability, impacting buyer interest in luxury properties.

- Global Influences: International economic conditions and foreign investment trends also affect the luxury real estate market in various regions.

- Technological Advancements: Innovations in smart home technology and sustainable living can increase property desirability and perceived value.

Staying informed about these trends can help potential buyers make strategic decisions when entering the luxury real estate market.

Significance of Location

Location is a fundamental aspect influencing the value and desirability of luxury properties. The following points illustrate why location matters significantly in luxury home investments:

- Proximity to Amenities: Luxury homes located near high-end shopping, fine dining, and cultural landmarks tend to have higher demand and appreciation potential.

- Neighborhood Reputation: Areas known for their exclusivity and prestige often yield better returns on investment, as they attract affluent buyers.

- Scenic Views: Properties with stunning views or unique landscapes can command premium prices, enhancing their long-term investment appeal.

- School Districts: Access to highly rated schools can significantly influence family-oriented buyers, boosting property values.

- Safety and Security: Locations perceived as safe and secure tend to attract high-net-worth buyers and maintain stable property values.

Investing in a luxury home in a prime location not only enhances the living experience but also acts as a safeguard for your investment’s long-term value.

Strategies to Avoid Hidden Costs

Navigating the luxury real estate market can be an exhilarating yet daunting experience, especially when it comes to uncovering hidden costs that aren’t immediately apparent. To ensure a purchase aligns with your financial goals, it’s crucial to adopt strategies that help identify and mitigate these unexpected expenses. This guide offers actionable tips and comprehensive methods to assess the true value of a luxury home beyond its asking price.

Actionable Tips for Uncovering Hidden Costs

Understanding the full financial picture before purchasing a luxury home is essential. The following strategies can help you uncover hidden costs:

- Conduct Thorough Market Research: Investigate similar properties in the neighborhood to gauge average costs for maintenance, utilities, and other expenses that may not be included in the price.

- Hire a Home Inspector: A professional inspection can reveal potential issues such as structural problems or outdated systems that could lead to costly repairs later.

- Request Full Disclosure: Ensure that the seller provides a comprehensive disclosure statement detailing repairs and renovations made, along with associated costs.

- Engage a Real Estate Attorney: Consulting with a real estate attorney can help you understand contractual obligations and identify any hidden fees associated with the purchase.

- Review HOA Rules and Fees: If applicable, examine the homeowners’ association rules and fees, as these can significantly impact your ongoing expenses.

Assessing the True Value of a Luxury Home

Looking beyond the asking price is crucial for evaluating a luxury home’s true value. Here are methods to consider:

- Analyze Comparable Sales: Compare recent sales of similar properties in the same area to determine if the asking price is justified based on market trends.

- Consider Future Development Plans: Investigate any planned developments in the area that may affect property values, such as new schools, parks, or commercial spaces.

- Evaluate Unique Features: Identify distinctive features (e.g., architectural design, landscaping, or energy-efficient installations) that may add value, and assess how they compare to standard offerings.

- Examine Historical Value Trends: Research how property values have changed in the neighborhood over time to predict future appreciation or depreciation.

- Seek Expert Opinions: Consult reputable appraisers or luxury real estate agents who can provide insights into market conditions and property value estimations.

Checklist for Evaluating Luxury Home Investments

To streamline your assessment process, keep this checklist handy when evaluating potential luxury home investments:

- Property Inspection: Ensure a detailed home inspection has been completed and reviewed.

- Title Review: Confirm that the property has a clear title with no liens or encumbrances.

- Financial Analysis: Create a comprehensive budget including purchase price, taxes, insurance, and estimated maintenance costs.

- Neighborhood Assessment: Evaluate the neighborhood, considering safety, amenities, and future development potential.

- Legal and Regulatory Review: Verify any zoning laws or restrictions that may impact your property usage.

- Long-Term Investment Review: Assess the property’s potential for appreciation and how it fits into your overall investment strategy.

“Investing in a luxury home requires more than just understanding purchase costs; it involves a thorough analysis of ongoing expenses and potential future liabilities.”

Conclusion

In the world of luxury home buying, understanding the full scope of costs is essential for making an informed decision. Potential buyers must recognize that the initial purchase price is just the beginning of a comprehensive financial commitment. A well-rounded approach to purchasing a luxury home involves not just the allure of opulence but also a meticulous evaluation of all associated costs.

Awareness of the hidden costs can mean the difference between a sound investment and unforeseen financial strain. Luxury homes often come with unique features and maintenance requirements that can inflate ongoing expenses. By crafting a comprehensive financial plan that considers these factors, buyers can protect themselves from potential pitfalls. The importance of thorough research cannot be overstated; it empowers buyers to navigate the complexities of the luxury real estate market with confidence.

Key Considerations for a Financial Plan

Establishing a robust financial plan involves several key considerations that can mitigate the risks associated with luxury home buying. These considerations include:

- Conducting a detailed cost analysis that encompasses not only the purchase price but also estimates for maintenance, insurance, and property taxes.

- Setting aside a contingency fund to address unexpected repairs or emergencies that could arise from high-end features.

- Consulting with financial advisors or real estate experts who specialize in luxury properties to gain insights into the current market trends and potential future costs.

- Understanding and comparing financing options available, such as jumbo loans or tailored mortgage products that cater specifically to high-net-worth individuals.

- Evaluating the long-term investment potential of the property, including market appreciation rates and neighborhood growth.

Investing in a luxury home can be an enriching experience when approached with diligence and strategic foresight. By prioritizing research and financial planning, buyers can enjoy their dream home without the burden of unexpected financial challenges.

Clarifying Questions

The Hidden Costs of Buying a Luxury Home and How to Avoid Them – What are the common hidden costs when buying a luxury home?

Common hidden costs include maintenance fees, property taxes, insurance, and expenses related to luxury features and amenities.

How can I estimate ongoing maintenance costs?

A good rule of thumb is to budget 1% to 2% of the home’s value annually for maintenance and repairs.

Are luxury homes harder to finance than regular homes?

Financing can be more complex for luxury homes due to higher price points and stricter lender requirements.

What should I look for in a real estate agent for luxury homes?

Seek an agent with specialized experience in luxury markets, as they understand the nuances and can negotiate better on your behalf.

Is it worth investing in luxury real estate?

Investing in luxury real estate can be worthwhile, but it’s crucial to consider market trends and property location for long-term value.