Introduction to Early Retirement and Real Estate

Early retirement is an appealing prospect for many individuals seeking to escape the traditional 9-to-5 grind. This lifestyle choice allows for greater freedom, enabling individuals to pursue passions, travel, or spend more time with family. The primary benefit of early retirement is the ability to enjoy life on one’s own terms, without the constraints of a conventional work schedule. To achieve this goal, many people look towards creating sustainable income streams that can support their desired lifestyle.

Real estate has emerged as a popular avenue for generating income, providing a reliable and often lucrative path to financial independence. By investing in various types of real estate, individuals can create revenue-generating opportunities that contribute to their retirement fund. This strategy not only helps in accumulating wealth but also offers the potential for passive income streams that can sustain one’s lifestyle during retirement.

Types of Real Estate Investments for Income Generation

Understanding the different types of real estate investments is crucial for building a diverse and lucrative portfolio. Each type of investment carries its own set of risks and rewards, and the right fit often depends on individual financial goals and risk tolerance. Below are some common types of real estate investments suitable for generating income:

- Rental Properties: Residential rental properties allow owners to earn monthly rent from tenants. This can provide a steady cash flow, often making it a favored choice among real estate investors.

- Commercial Real Estate: Investments in commercial properties, such as offices, retail spaces, or warehouses, can yield higher returns compared to residential properties. These properties often have longer lease terms and can be more financially stable.

- Real Estate Investment Trusts (REITs): REITs offer a way for individuals to invest in real estate without directly owning properties. These companies own, operate, or finance income-generating real estate and distribute dividends to shareholders.

- Short-Term Rentals: Platforms like Airbnb enable property owners to rent out their homes or apartments for short stays, potentially generating higher income than traditional long-term rentals.

- Real Estate Crowdfunding: This investment method allows individuals to pool their money together to invest in larger real estate projects, such as commercial developments or multi-family housing, thus diversifying their investment without needing substantial capital.

Incorporating a mix of these investment types can enhance income potential and reduce risk. Each choice offers unique opportunities to build wealth, ensuring that individuals can enjoy their retirement years without financial stress.

“Real estate, when done right, can provide an invaluable source of income, allowing for early retirement and financial freedom.”

Understanding Real Estate Income Streams

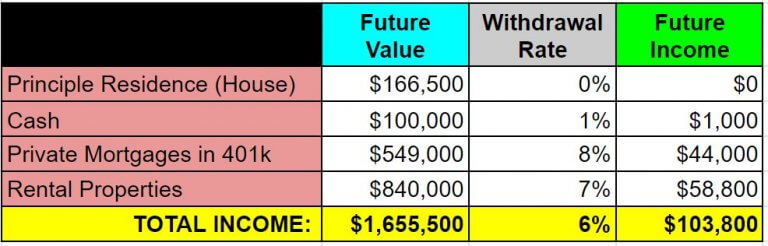

Real estate has proven to be a reliable avenue for generating income, particularly for those looking to retire early. Understanding the various income streams available from real estate is crucial for building a sustainable financial future. This section will explore different types of real estate income, providing examples and potential returns to help you assess which might best suit your retirement goals.

Types of Real Estate Income Sources

Real estate income can stem from several sources, each with its unique characteristics and potential returns. Here are the key types of real estate income streams:

- Rental Properties: Owning residential or commercial properties that are rented out can provide steady monthly income. For instance, a single-family home rented at $1,500 per month can yield an annual income of $18,000. After accounting for expenses like property management, maintenance, and taxes, net returns may range from 6% to 10% annually, depending on location and property value.

- Real Estate Investment Trusts (REITs): These are companies that own, operate, or finance income-producing real estate. Investors can buy shares in a REIT, similar to stocks. Historically, REITs have offered annual returns averaging around 8% to 12%. For example, an investment of $10,000 in a well-performing REIT could potentially yield $800 to $1,200 annually, depending on market conditions.

- Crowdfunding Platforms: This relatively new investment avenue allows individuals to pool resources to invest in real estate projects. Platforms like Fundrise or RealtyMogul offer access to diverse real estate opportunities with varying minimum investments. Returns can range from 5% to 15% annually, depending on the project. For instance, a $5,000 investment in a crowdfunded project could yield returns of $250 to $750, again subject to performance and risks.

Passive versus Active Real Estate Income

Understanding the difference between passive and active income in real estate is essential for prospective investors. Active income involves direct involvement in property management or investment activities, while passive income requires minimal effort after the initial investment.

Active income can be lucrative but often demands significant time and effort. For example, managing rental properties, negotiating leases, and handling tenant issues require ongoing involvement. On the contrary, passive income streams like REITs or crowdfunding involve a one-time investment with little to no day-to-day management, making it easier for those seeking early retirement.

“Passive income allows investors to earn money while focusing on other pursuits, making it an attractive option for those planning for early retirement.”

In summary, understanding these income streams and their implications can guide you in making informed decisions that align with your retirement aspirations.

Setting Financial Goals for Early Retirement

Establishing solid financial goals is crucial for anyone looking to retire early, especially when leveraging real estate as a primary income source. This section will clarify how to determine the income needed for early retirement, create a detailed plan for budgeting and saving, and highlight the importance of having a financial safety net.

Setting a clear framework is essential in understanding how much income you’ll need to retire comfortably. Begin by calculating your estimated annual living expenses in retirement, considering factors like housing, healthcare, and leisure activities. Once you have that number, you can determine the total amount of income needed from your real estate investments. The rule of thumb is to aim for a net income that covers your expenses and ideally allows for a little extra for unexpected costs or lifestyle enhancements.

Framework for Determining Income Needs

To create an accurate framework for your income needs, follow these steps:

1. Identify Monthly Expenses: List all your anticipated monthly expenses, including mortgage or rent, utilities, groceries, transportation, insurance, and entertainment. This gives you a clear picture of your monthly cost of living.

2. Calculate Annual Living Expenses: Multiply your monthly expenses by 12 to establish your annual living costs. For instance, if your monthly expenses total $3,000, your annual expenses would be $36,000.

3. Account for Inflation: Consider future inflation rates. A conservative estimate might be 3% annually. Use this to adjust your annual expenses over the years leading to retirement.

4. Determine Income from Other Sources: Include any income you expect to receive from Social Security, pensions, or other investments. Subtract this from your total income needs from real estate.

5. Establish a Target Income from Real Estate Investments: This is your total income requirement minus any other income sources. For example, if your annual living expenses are $36,000 and you expect $12,000 from Social Security, you’ll need $24,000 from real estate.

Step-by-Step Plan for Budgeting and Saving

Creating a detailed plan for budgeting and saving is imperative for making your real estate investment goals a reality. Here’s a structured approach:

1. Set a Savings Target: Identify a specific amount you need to save for your first property investment. This is typically a percentage of the property’s price, often ranging from 10% to 20% for a down payment.

2. Create a Monthly Budget: Allocate funds from your income towards savings. Consider using the 50/30/20 rule, where 50% of your income goes to necessities, 30% to wants, and 20% to savings and debt repayment.

3. Establish an Investment Account: Open a separate savings or investment account specifically for your real estate investments. This helps keep your savings organized and prevents you from spending the funds on other expenses.

4. Automate Savings: Set up automatic transfers to your investment account right after you receive your paycheck. This ‘pay yourself first’ strategy ensures that you consistently save towards your goal.

5. Review and Adjust Regularly: Periodically review your budget and savings plan to ensure you’re on track. Adjust your spending or savings targets as needed based on changes in your financial situation or real estate market conditions.

Importance of Emergency Funds and Financial Buffers

Having an emergency fund and financial buffers is crucial in the world of real estate investing. These funds act as a safety net, ensuring you can manage unexpected expenses without jeopardizing your investments.

1. Emergency Fund: Aim to save three to six months’ worth of living expenses in a liquid account. This fund will provide financial security in case of a job loss, unexpected repairs, or other emergencies.

2. Property-specific Reserves: In addition to your general emergency fund, set aside reserves specifically for your real estate investments. This might include funds for property maintenance, unexpected vacancies, or major repairs.

3. Insurance Buffers: Ensure you have adequate insurance coverage for your properties. This includes homeowner’s insurance, landlord insurance, and possibly additional policies for natural disasters specific to your location.

4. Financial Flexibility: Having these buffers allows you to make strategic decisions, such as investing in new properties or improving existing ones, without the immediate pressure of covering unexpected costs.

5. Long-term Stability: A well-funded emergency buffer not only increases your peace of mind but also contributes to the long-term stability of your investment portfolio, enhancing your overall financial health as you approach early retirement.

Researching and Choosing the Right Market

Finding the best market for real estate investment is crucial for building the income streams that will enable early retirement. The right location can significantly impact your returns, making thorough research essential. By analyzing various markets, you can identify opportunities that align with your financial goals and risk tolerance.

Analyzing real estate markets involves using various methods and criteria to pinpoint locations that show strong potential for growth and profitability. Investors should consider factors such as economic indicators, population trends, and local rental demand. By gathering this information, you can make informed decisions about where to invest your resources.

Methods for Analyzing Real Estate Markets

Effective market analysis relies on both quantitative and qualitative methods. Here are some key approaches to consider:

- Market Comparisons: Compare different markets by examining metrics like average property prices, rental rates, and historical appreciation. Cities with lower prices but higher growth potential can be lucrative.

- Economic Indicators: Look at local economic health through job growth, unemployment rates, and income levels. Strong job markets usually correlate with increased demand for rental properties.

- Demographics: Analyze population growth trends, age distributions, and household compositions. A growing population often leads to increased housing demand.

- Rental Trends: Investigate vacancy rates and the average duration of rentals in the area. Low vacancy rates typically indicate strong rental demand.

Criteria for Selecting a Location for Investment

When selecting a location, several criteria should guide your decision-making process:

- Affordability: Ensure that property prices are within your budget, taking into account potential financing options.

- Growth Potential: Look for areas with planned infrastructure improvements or new businesses entering the market, as these can spur demand.

- Rental Yield: Calculate the rental yield to determine how much income the property will generate relative to its purchase price.

- Local Amenities: Properties near schools, parks, public transport, and shopping centers tend to attract more tenants.

Resources for Market Research

Accessing reliable resources is vital for effective market research. Here are some valuable tools and platforms that can assist in your analysis:

- Real Estate Websites: Platforms like Zillow, Redfin, and Realtor.com provide data on property prices, sales history, and neighborhood statistics.

- Local Government Resources: City or county websites often offer demographic data and insights into economic development plans.

- Real Estate Investment Groups: Joining local or online investment groups can provide invaluable insights and firsthand experiences from other investors.

- Market Research Reports: Companies like CoStar and CBRE offer detailed market research reports that can help identify trends and forecasts.

Financing Your Real Estate Investments

Understanding the various financing options available for real estate investments is crucial for anyone looking to retire early through real estate income streams. Financing serves as the foundation for purchasing properties, and the choices made here can significantly impact both short-term cash flow and long-term profitability. From traditional mortgages to alternative financing methods, there are several pathways to consider when funding real estate ventures.

Types of Financing Options

There are several financing options available for real estate purchases, each catering to different investment strategies and risk tolerances. The main financing options include:

- Conventional Loans: These are standard mortgages issued by banks and lenders that follow guidelines set by government-sponsored enterprises. They typically require a strong credit score and a down payment of 20% for investment properties.

- FHA Loans: Insured by the Federal Housing Administration, these loans are more accessible to first-time homebuyers and investors with lower credit scores, often requiring as little as 3.5% down for primary residences.

- VA Loans: Available to veterans and active-duty military personnel, VA loans offer favorable terms and conditions, such as no down payment and no private mortgage insurance (PMI).

- Hard Money Loans: These are short-term loans secured by real estate and funded by private investors or companies. They are useful for quick financing but come with higher interest rates.

- Private Money Loans: These loans come from individual investors rather than banks, providing flexibility and potentially better terms depending on the lender’s criteria.

- Seller Financing: In this case, the property seller acts as the lender, allowing the buyer to make payments directly to them. This can be beneficial for buyers who may not qualify for traditional financing.

Pros and Cons of Using Leverage

Leverage refers to the use of borrowed capital to increase the potential return on investment. While leveraging can amplify gains, it also comes with risks. Understanding these pros and cons is vital for making informed financial decisions.

- Pros:

- Increased Buying Power: Leverage allows investors to purchase more properties than they could with cash alone, enhancing the potential for greater returns.

- Tax Benefits: Mortgage interest payments are often tax-deductible, which can reduce overall tax liability and improve cash flow.

- Asset Appreciation: By using leverage, investors can benefit from property appreciation while only having invested a fraction of the total cost.

- Cons:

- Increased Risk: Higher leverage means higher monthly mortgage payments, which can strain cash flow, especially during market downturns.

- Market Volatility: Real estate markets can fluctuate, and leveraging can lead to significant losses if property values decline.

- Debt Obligations: Ongoing mortgage payments are a financial obligation that may impact overall financial stability, especially if rental income decreases.

Financial Planning for Mortgage Payments and Other Expenses

Creating a financial plan is essential for successfully managing real estate investments, ensuring that mortgage payments and other expenses are adequately covered. This plan should include a detailed budget that Artikels all income and expenses associated with the property.

Key components of a financial plan might include:

- Monthly Income: Estimate expected rental income based on market research, considering factors like vacancy rates and seasonal fluctuations.

- Mortgage Payments: Calculate the total monthly mortgage payment, including principal, interest, taxes, and insurance (PITI).

- Maintenance and Repairs: Set aside a percentage of rental income (typically 1-2%) for ongoing maintenance and unexpected repairs.

- Property Management Fees: If using a property management service, factor in their fees, which can range from 8-12% of monthly rental income.

- Insurance Costs: Include costs for property insurance, liability coverage, and any additional policies necessary for investment properties.

- Emergency Fund: Establish a reserve fund for unexpected costs to ensure financial stability during challenging times.

Incorporating these elements into a comprehensive financial plan helps investors maintain a clear view of their cash flow and long-term investment performance, ultimately supporting their goal of early retirement through real estate income streams.

Property Management Strategies: How To Retire Early Using Real Estate Income Streams

Effectively managing rental properties is crucial for maximizing income and ensuring a steady cash flow in your real estate investments. Implementing efficient property management strategies not only helps maintain the quality of your properties but also enhances tenant satisfaction, which can lead to longer lease terms and reduced turnover rates.

Tips for Efficiently Managing Rental Properties

Maximizing income from rental properties requires a well-structured approach to management. Here are some essential strategies to consider:

- Regular Communication: Maintain open lines of communication with tenants to address concerns and requests promptly.

- Automate Rent Collection: Utilize online platforms to streamline the rent payment process, reducing late payments and improving cash flow.

- Conduct Regular Inspections: Schedule routine property inspections to identify maintenance issues early and avoid costly repairs later.

- Professional Property Management: Consider hiring a property management company if you own multiple properties or lack the time to manage them efficiently.

Tenant Screening and Management Checklist

A thorough tenant screening process is vital for ensuring reliable and responsible tenants. The following checklist can help streamline tenant selection:

- Application Form: Collect detailed applications with personal, employment, and rental history information.

- Credit Check: Perform credit checks to assess financial responsibility and creditworthiness.

- Background Check: Investigate criminal history and previous evictions to ensure tenant reliability.

- References: Contact previous landlords or employers for insights into the applicant’s behavior and reliability.

Impact of Property Maintenance on Income Streams

Proper maintenance of rental properties plays a significant role in sustaining income streams. Neglected properties can lead to tenant dissatisfaction and increased turnover, affecting profitability. Consider the following aspects:

- Routine Maintenance: Implement a proactive maintenance plan to address issues before they escalate, thus preserving property value and tenant satisfaction.

- Budget for Repairs: Set aside a portion of rental income for ongoing repairs and improvements to keep the property appealing and functional.

- Energy Efficiency Upgrades: Invest in upgrades like new windows or energy-efficient appliances, which can attract quality tenants and reduce operational costs over time.

Diversifying Your Real Estate Portfolio

Diversifying your real estate portfolio is a crucial strategy for reducing risk and enhancing potential returns. By spreading investments across various property types and markets, you can cushion against economic downturns and fluctuations in specific sectors. This approach not only stabilizes income but also opens up opportunities for growth and increased cash flow.

One effective way to diversify is by investing in different property types. Residential, commercial, industrial, and retail properties each have unique risk profiles and income streams. For instance, while residential properties may provide steady rental income, commercial properties often yield higher returns but can be more sensitive to economic conditions. By allocating funds across these varied property types, investors can mitigate risks associated with market volatility.

Benefits of Diversifying Across Property Types

Understanding the benefits of diversifying across different property types is essential for creating a balanced investment strategy. Each type of property responds differently to market changes, which can help stabilize your overall investment portfolio. Consider the following benefits:

- Risk Mitigation: By investing in multiple property types, you reduce the impact of poor performance in any single sector. For example, if the residential market suffers a downturn, commercial properties may still provide stable income.

- Cash Flow Stability: A mix of property types can ensure consistent cash flow, as different tenants may have varying lease structures and payment terms that can balance out income fluctuations.

- Growth Opportunities: Investing in emerging markets or property types can lead to significant appreciation in value. For instance, consider investing in multifamily properties in a growing urban area where demand is increasing.

- Enhanced Market Insights: Broadening your investment scope allows you to gain insights across various sectors, helping you make more informed decisions about when and where to invest next.

Incorporating these strategies into your investment approach can significantly enhance your portfolio’s overall performance. For example, a balanced portfolio might include a combination of single-family homes for steady rental income, a commercial retail space in a high-traffic area for growth potential, and perhaps even a vacation rental property in a tourist hotspot to capitalize on seasonal demand.

By understanding the dynamics of each property type and effectively managing the associated risks, you can build a robust and resilient real estate portfolio that supports your early retirement goals.

Tax Implications and Benefits of Real Estate Investing

Investing in real estate is often touted for its potential to generate significant income and build wealth, but it also offers a variety of tax implications and benefits that can enhance your investment strategy. Understanding these tax advantages and obligations is crucial for optimizing your returns and planning for early retirement.

Real estate investments come with several tax advantages that can reduce your overall taxable income. One of the most significant benefits is the ability to deduct certain expenses related to property management, maintenance, and improvements. Additionally, real estate investors can take advantage of depreciation, which allows for the reduction of taxable income over the life of the property.

Common Tax Advantages of Real Estate Investments

Real estate offers unique tax benefits that can significantly impact your investment profitability. Here are some key advantages that qualifying investors can leverage:

- Mortgage Interest Deduction: Investors can deduct the interest paid on mortgages for rental properties from their taxable income.

- Depreciation: Properties can be depreciated over time, allowing investors to write off a portion of the property’s value each year, which reduces taxable income.

- Property Expense Deductions: Investors can deduct operational costs such as property management fees, maintenance, utilities, and repairs.

- 1031 Exchange: This allows investors to defer capital gains taxes on investment properties when exchanging them for another property of equal or greater value.

- Qualified Business Income Deduction: Under certain conditions, real estate investors may qualify for a 20% deduction on qualified business income, further reducing their tax liability.

Tax Obligations Associated with Real Estate Income

While there are numerous tax benefits associated with real estate investing, it’s also important to understand the obligations that come with generating rental income. Investors must report rental income on their tax returns, which may increase their tax liability.

Key obligations include:

- Reporting Rental Income: All rental income must be declared on Schedule E of IRS Form 1040.

- Self-Employment Tax: If you manage your rental properties as a business, you may be subject to self-employment taxes on profits.

- Local and State Taxes: Depending on the jurisdiction, additional taxes such as property taxes or local business taxes may apply.

- Capital Gains Tax: When selling an investment property, any profit made may be subject to capital gains tax unless a 1031 exchange is utilized.

Strategies for Maximizing Tax Benefits, How to Retire Early Using Real Estate Income Streams

To enhance profitability, investors can adopt various tax strategies that allow them to maximize available benefits while minimizing liabilities. Consider the following strategies:

- Keep Detailed Records: Maintain thorough documentation of all income and expenses associated with your properties to ensure accurate tax reporting.

- Consider Entity Formation: Forming an LLC or other business entity can offer liability protection and potential tax benefits.

- Utilize Tax Professionals: Consulting a tax advisor specialized in real estate can help identify eligible deductions and strategize for tax efficiency.

- Plan for Depreciation: Develop a depreciation schedule that aligns with property improvements to maximize tax benefits.

- Monitor Tax Law Changes: Stay informed about changes in tax legislation that may impact real estate investments to adjust strategies accordingly.

“Understanding and leveraging the tax implications of real estate investing can significantly enhance your financial outcomes and expedite your journey to early retirement.”

Planning for Market Fluctuations

In the realm of real estate investing, navigating market fluctuations is essential for sustaining long-term income and growth. Economic downturns can pose significant challenges, but with the right strategies in place, investors can weather these storms and maintain profitability. Understanding how to prepare for these eventualities is crucial for anyone looking to retire early through real estate income streams.

To effectively manage the risks associated with economic instability, investors should focus on several key strategies that promote resilience and income stability. By being proactive, investors can safeguard their portfolios against potential downturns. Here are some strategies that can help maintain income during market instability:

Strategies for Maintaining Income

Diversifying income sources and preparing for potential market shifts can provide a safety net during downturns. Below are effective strategies that can be employed:

- Build an Emergency Fund: Having cash reserves allows you to handle unexpected expenses without impacting your investment properties.

- Focus on Stable Markets: Invest in markets with strong rental demand and lower volatility, as they typically recover faster from downturns.

- Establish Strong Tenant Relationships: Maintaining good communication and providing value can lead to tenant retention, minimizing vacancy rates during tough times.

- Consider Short-term Rentals: Using platforms like Airbnb can help generate higher income during peak seasons, balancing out slow rental periods.

- Regular Property Maintenance: Keeping properties in good condition can prevent larger expenses in the future, preserving cash flow.

The importance of monitoring specific indicators that signal shifts in the real estate market cannot be overstated. Recognizing these signs early can allow investors to adjust their strategies accordingly. Key indicators to watch include:

Indicators of Market Shifts

Understanding the economic landscape is essential for anticipating market changes. Investors should keep an eye on the following indicators:

- Interest Rates: Rising interest rates can lead to decreased buyer activity, affecting property values and rental demand.

- Employment Rates: Job growth or significant layoffs in an area can influence rental demand and property values.

- Rental Vacancy Rates: An increase in vacancy rates may indicate oversupply or declining demand, signaling potential issues within the market.

- Consumer Confidence Indices: Low consumer confidence can lead to diminished buying activity, impacting the overall real estate market.

- Market Inventory Levels: A sudden increase in available properties can indicate a shift toward a buyer’s market, influencing pricing strategies.

By staying informed and prepared, real estate investors can effectively navigate the uncertainties of the market, ensuring they remain on track for their early retirement goals.

Building a Network and Resources

Creating a robust network of real estate professionals is crucial for anyone looking to retire early through real estate income streams. This network not only provides support and guidance but also opens doors to investment opportunities, partnerships, and insights that can significantly enhance your real estate journey. A well-established network can serve as a valuable resource when navigating the complexities of real estate investing.

Networking in real estate goes beyond merely attending events; it involves building genuine relationships with various professionals in the field. This includes real estate agents, mortgage brokers, property managers, contractors, and fellow investors. Engaging with these individuals can lead to mentorship opportunities and the exchange of vital information about market trends and best practices.

Creating a Supportive Network

Building a supportive network requires intentional effort and strategic engagement. Here are some effective tips for establishing a strong network within the real estate community:

- Attend local real estate meetups and networking events to connect with like-minded individuals.

- Join real estate investment clubs or associations to gain access to a broader network of professionals.

- Utilize social media platforms such as LinkedIn and Facebook groups focused on real estate investing.

- Engage in discussions and contribute valuable insights in online forums dedicated to real estate.

- Volunteer for real estate-related events or charitable causes to meet new contacts and build relationships.

The Importance of Mentorship

Mentorship in real estate investing can significantly accelerate your learning curve and success. A mentor can provide personalized guidance, share their experiences, and help you avoid common pitfalls. They can also introduce you to their network, expanding your resources even further. The relationship should be mutually beneficial, where you respect their time and expertise while being open to receiving feedback and advice.

Online Resources and Communities

Continuous learning is essential in real estate investing, and there are numerous online resources that can help you stay informed and connected. Below is a curated list of valuable online platforms, forums, and communities:

- BiggerPockets: A comprehensive resource for real estate investors featuring forums, podcasts, and articles.

- Real Estate Investing Subreddits: Engage with communities on Reddit such as r/realestateinvesting and r/landlord.

- LinkedIn Groups: Join groups like Real Estate Investing Group to network and learn from industry professionals.

- Facebook Groups: Participate in groups such as Real Estate Investors and Real Estate Wholesalers to connect with fellow investors.

- Podcasts: Listen to shows like “The Real Estate Guys” and “BiggerPockets Podcast” for insights and strategies.

“In real estate, your network is your net worth.”

Top FAQs

How to Retire Early Using Real Estate Income Streams – What types of real estate investments are best for beginners?

Beginners often find success with rental properties and Real Estate Investment Trusts (REITs) due to their accessibility and lower risk.

How much capital do I need to start investing in real estate?

It varies, but you can start with as little as 20% down payment for a property, or even less with certain financing options or partnerships.

Is it necessary to hire a property manager?

While it’s not mandatory, hiring a property manager can save you time and ensure that your rental properties are managed professionally.

How do taxes affect real estate income?

Real estate income can be taxed, but there are several deductions and tax benefits available that can help reduce your overall tax burden.

What should I do if the real estate market crashes?

Stay calm, evaluate your investments, and consider diversifying your portfolio or adjusting your strategies to manage risk during downturns.